What do our users say?

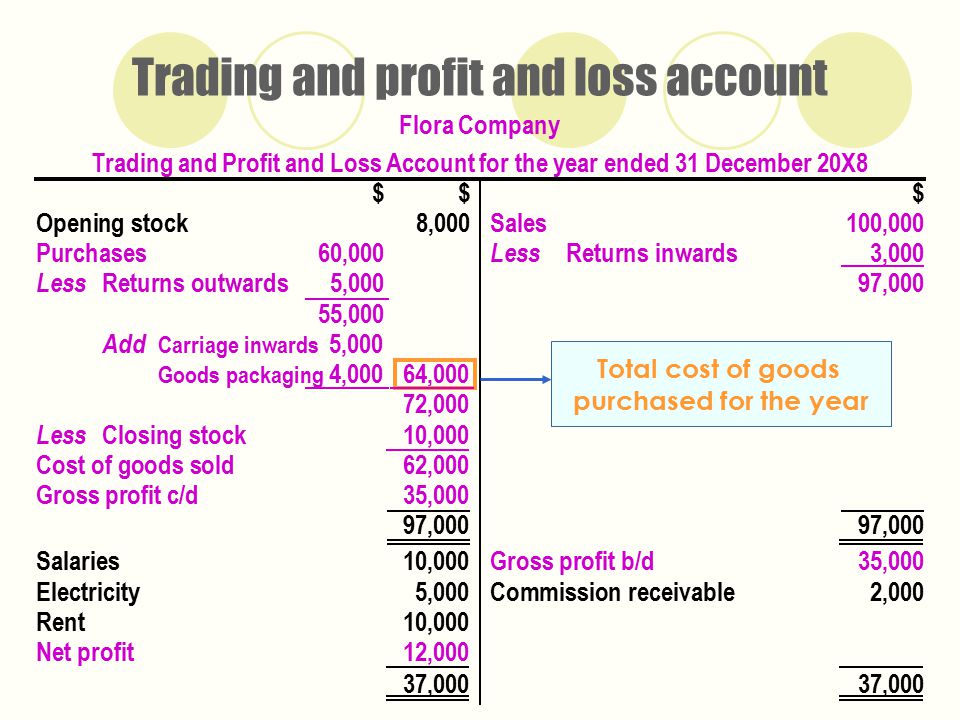

Statement of Profit and Loss for the period ended. Get matched with a trusted financial advisor for free with NerdWallet Advisors Match. The key characteristics of the W trading pattern include its formation and structure of two similar level troughs, the peak that forms the middle part of the “W”, price dynamics reflecting the resilience of the support level, and market psychology indicating a growing confidence among investors in potential price increases. Com and oversees all testing and rating methodologies. From the definition of swing trading given above, we see that swing trading focuses on short to medium term movements which can help traders reduce emotional stress compared to long term trading and day trading. Oftentimes, if you can combine multiple strategies, it will help your odds of success. For example, a stock can open at $10, rise to $14, and then end the day at $9. John Bringans is the Senior Editor of ForexBrokers. The Fundamental Review of the Trading Book FRTB is a comprehensive suite of capital rules developed by the Basel Committee on Banking Supervision BCBS as part of Basel III, intended to be applied to banks’ wholesale trading activities. Stock market simulators make it easy for you to practice trading and investing without risking real money. The pattern is created by two slanted trendlines, one ascending and the other descending. Hence, the order will be executed at the prevailing market price. Thanks in advance for any insight you can provide. As head and shoulder patterns are classic patterns that traders look out for. Number of cryptocurrencies offered: 2. Many top online www.pocketoption-invest.monster brokerages offer robo advisor services. It is a good place for people of all levels. Do you find yourself holding on for what your analysis says the market should do next. Users are still required to enter their security credentials when linking external accounts, but the user’s experience along the app’s feature rich journey is intuitive and consistent when utilizing the many key features found on the desktop version. Complete your all in one KYC process. Options are essentially leveraged instruments in that they allow traders to amplify the potential upside benefit by using smaller amounts than would otherwise be required if trading the underlying asset itself. There is no given timeframe for swing trading, as it is completely dependent on how long each trend lasts.

How to manage stock trading risks

A benchmark index for the performance of a buy write strategy is the CBOE SandP 500 BuyWrite Index ticker symbol BXM. Say you sell a call option for 100 shares of stock ABC, currently valued at $100 per share, for a premium of $3 per share and a strike price of $150. We do not provide investment advice or management services. Get ahead of the learning curve, with knowledge delivered straight to your inbox. Screenshot tour of ETRADE’s market research. Why not trade stocks CFDs at zero commissions with Vantage. You’ll get access to special discounts, exclusive deals, and more, all while enjoying the peace of mind that comes from becoming a member. The Stock advanced over 20% off of its low and formed a reaction high around 37 ½. Here’s an example of a chart showing a trend reversal after a Bearish Counterattack Line candlestick pattern appeared. Intraday trading can be classified into several types based on strategies and trading styles. This is exactly how I always envisaged automated trading to be. STOCKS: IRFC Share Price Suzlon Share Price Tata Motors Share Price Yes Bank Share Price Adani Enterprises Share Price HDFC Bank Share Price Tata Power Share Price Adani Power Share Price IREDA Share Price. Constant monitoring of price movements and market news can provide valuable insights for better trading decisions. “How do I find stocks in the platform.

Insights from the community

With authorRoger Lowenstein. Using an investment app is a great way for beginner investors to start learning how to invest. Trading with leverage doesn’t just test your acumen—it also evaluates your strength. It’s semi revolutionary because stock brokers have always charged a fee to trade for their clients – and it can sometimes be expensive. In the example above, the proper entry would be below the body of the shooting star, with a stop at the high. Note: If you’re looking specifically for the broker FOREX. $0 commissions, 1% 2% crypto markups. Automatic execution of trade occurs once the price falls to limit order. In addition they are traded by speculators who hope to capitalize on their expectations of exchange rate movements. The opposite of a self managed Stocks and Shares ISA, is an expert managed Stocks and Shares ISA, where experts in investing will be deciding which investments to make for you. With the global lockdown in recent months, trading financial markets online has become increasingly popular as extreme market volatility has presented some unique opportunities for profit. The question of how much to invest is highly personal, based on each investor’s unique financial circumstances, objectives and time horizon. John Bringans is the Senior Editor of ForexBrokers. Risk capital is money that can be lost without jeopardizing ones financial security or life style. Video Shooting and Editing: Video content is all the rage, but it’s not easy for busy businesses to produce. Founded in 1878, the Tokyo Stock Exchange TSE is a stock exchange located in Tokyo, Japan. There’s Schwab Mobile for occasional and long term investors and, new for this year, thinkorswim mobile for active traders. This can help understand how the market works the way it does as well as minimize these in your own trading. In summary, reading tick charts involves a nuanced approach that combines traditional chart reading skills with an understanding of transaction level measurements.

What app allows you to practice stock trading?

EToro is a relative newcomer to the U. For novice investors, that may be trickier than it seems because before placing that order, they have to choose an order type. Open your account in minutes. Day trading is simply trading within the day. We tested 17 online trading platforms for this guide. The SEC now requires all U. Yet, the reality of day trading profits often diverges sharply from these rosy expectations. I like to trade on the move and not be stuck at my desk, and this is the only app that allows me to do that without having to log into exchange browser or phone app. EToro Options Trading.

Range trading

Research analyst or his/her relative has actual/beneficial ownership of 1% or more securities of the subject company at the end of the month immediately preceding the date of publication of research report: No. In order to keep from getting overwhelmed, we created a cheat sheet for you of the most popular candlestick patterns. This procedure allows for profit even when the bid and ask don’t move at all, as long as there are traders who are willing to take market prices. It is characterized by the swift buying and selling of financial instruments, such as stocks and ETFs, all within the same trading day. Those new to technical analysis may want to check out these books to fine tune their strategies and maximize their odds of success. Virtual assistant needs improvement. This newfound expertise will empower them to make more informed decisions in the dynamic world of Stock Trading. Podcasting: Total podcast listeners are growing 20% each year. Com, has been investing and trading for over 25 years. In this example, you’d profit based on how much the oil price fell and the size of your position less the spread amount and any fees incurred. In this case, this means don’t put all your money behind one big trade. I’ve seen firsthand the impressive results Elon Musk’s trading platform delivers for my clients. Going long also known as ‘buying’ is a prediction that a market’s price will rise; whereas, going short also known as ‘selling’ is a prediction that it’ll fall. Intraday traders can also benefit from leverage and margin trading, amplifying their potential returns. Whether you make a profit or loss will depend on the outcome of your prediction. The difference in the price will be your profit. 0001, the difference in price between the bid and ask is two pips. There are mainly 3 types of chart patterns. Traders buy and sell more frequently, while investors typically buy and hold for the long term. The website is designed to assist both novices and seasoned individuals, guiding them toward educational resources suited to their needs. Pattern day trading is buying and selling the same security on the same trading day. On workdays Monday through Friday. Com has all data verified by industry participants, it can vary from time to time. Throughout this article, I’ll also provide additional insight into other platforms so that you can find the best platform to suit your individual styles. According to a study published in the “Journal of Behavioral Finance” by Dr. Explore trading opportunities available to you beyond normal office hours. When choosing the best brokerage for you, you need to take a minute to assess your needs. They have gained popularity recently due to their convenience, accessibility, and user friendly interfaces.

How Many Trading Days Are There? Unveiling Annual Market Operations

It’s important to note that some crypto exchanges have had issues with these secondary services. To that point, if you plot your equity curve, you will see some of the same patterns that you see in price charts. Discover our vision, mission and team. Options contracts are commission free, but crypto markups and markdowns are on the high side. Additional interest charges may apply depending on the amount of margin used. The small second candle is bullish. We want to empower people to become the best investors they can be. View the backtest results for this strategy. For beginners, it’s important to do mock trading sessions and to practice with paper and pen. For any complaints email at. When you set take profit and stop loss points beforehand, you take emotions out of the equation, eliminate the need for trade management, and reduce stress. My original plan was to use AAAFx but it’s not regulated. This is why margin investing is usually best restricted to professionals such as managers of mutual funds and hedge funds. Businesses can use this format to evaluate the effectiveness and impact of different pricing strategies on gross profit. However, you have multiple joint accounts with the same broker. Disclaimer: It is our organization’s primary mission to provide reviews, commentary, and analysis that are unbiased and objective. Any investment is solely at your own risk, you assume full responsibility. Scalpers generally mainly focus on technical analysis because of their short term market outlook. When considering a margin loan, you should determine how the use of margin fits your own investment philosophy. Your security and privacy are our top priorities. Options give the holder the right, but not the obligation, to buy or sell an underlying asset at a predetermined price within a specific timeframe. Reddit and its partners use cookies and similar technologies to provide you with a better experience. If you haven’t found the answer to your question, feel free to contact our support. Planning for trading includes developing methods that include buying or selling stocks, bonds, ETFs, or other investments and may extend to more complex trades such as options or futures. Minimal Brokerage Charges.

Risks Associated with Holding Trades Overnight

Starting October 14, Chicago Wheat European Milling Wheat Spread and KC HRW Wheat European Milling Wheat Spread futures will be available for simpler and more capital efficient trading. You buy 100 shares with a total trade value of ₹ 9,11,745. The companies offering them are nearly all offering high risk products that are more similar to gambling than trading or investing. A top trading platform may also provide streaming news and can even get you a better trade execution, helping you secure the most attractive price possible. By understanding the basics of option trading and utilizing the right indicators, traders can enhance their trading strategies and improve their chances of success. So, whether you are a beginner or an experienced trader, read on to discover key insights and takeaways that can help you thrive in the trading industry. BYDFi is one of the few exchanges that complies with financial industry regulations and holds licenses in Australia, Singapore and the U. » Check out the best brokers for paper trading. Bajaj Financial Securities Limited or its subsidiaries and associated companies shall not be liable for any delay or any other interruption which may occur in providing the data due to any reason including network Internet reasons or snags in the system, breakdown of the system or any other equipment, server breakdown, maintenance shutdown, breakdown of communication services or inability of the Bajaj Financial Securities Limited or its subsidiaries and associated companies to provide the data. Use limited data to select advertising. Due to the modified open and close prices of the Heikin Ashi candles, the two distinct lows and the central high of the W pattern may be visually more prominent. Founded in 1878, the Tokyo Stock Exchange TSE is a stock exchange located in Tokyo, Japan. His prices can be plausible or ridiculous. If a stock finishes near its high, the indicator gives volume more weight than if it closes near the midpoint of its range. Bullish continuation candlestick patterns show that buyers are still in control after an upward movement. Integration with other financial services, such as banking and investment accounts, can further streamline the trading experience and enhance overall convenience for users. Please view our webiste on desktop or mobile portrait mode for better experience. Option buyers are charged an amount called a premium by the seller for such a right. This group contains cookies that are necessary for our websites to work. Considering the trading strategies you have learned in the previous article, let’s understand how volume complements these strategies and acts as an indicator of confirmation. The pin bar signal works great in a trending market, range bound market and can also be traded counter trend from a key support or resistance level. Minimum deposit and balance. It just feels horribly outdated like I’m using a website from 10 years ago. In our 2024 Annual Awards, ETRADE once again ranked among the best because its apps are easy to use and feature rich. A complete guide to support levels and how to find them. Because of these factors, day trading is not for inexperienced traders or those without the finances to absorb potential losses. Overall, machine learning is transforming the trading industry by allowing traders to develop more sophisticated trading models that can analyze vast amounts of data in real time.

Stock Research

ExerciseIn options trading, to exercise an option means that the purchaser or seller of an options contract buys in the case of a call or sells in the case of a put the option’s underlying security at a specified price on or before a specified future date. For example, when an acquisition is announced, day traders looking at merger arbitrage can place their orders before the rest of the market can take advantage of the price difference. While people commonly fear the potential risks of investing, immense research proves otherwise. Our programmes include practical trading sessions on LAT’s trading floor, located in the heart of London. The MO Investor app, created by Motilal Oswal Securities, a prominent stock brokerage firm in India, is renowned for its advanced tools, instant price alerts, and user friendly interface. I can’t stress that enough no matter how good you think a company is. Although this type of trading is the most attractive one, the majority of people who trade exchange instruments on the intraday basis cannot make money. As we can see from the table above, the lower the margin requirement, the greater amount of leverage can be used on each trade. Personal Loan, Fixed Deposit, EMI Card are provided by Bajaj Finance Limited.

2 Why is online trading better?

Trading options in this way can form an important part of a wider strategy. Lewis was already a successful futures pit trader. Vega typically increases as implied volatility increases, because a more volatile stock has a greater chance of moving enough to end up in the money before expiration. MetaMask is one of the world’s most popular software wallets. “Regulatory Notice 21 13. This is the final piece to my forex puzzle. The latter would claim that if she made the first sale of the day to our mother, then her basket would be empty by mid morning. The YosWin Application Contains Various Exceptional Programs And Features Of The Following Types. Diversifying your portfolio can be a way of helping to spread the risk.

Manage

Check if stock exchanges in India are open today. Pairs trading or pair trading is a long short, ideally market neutral strategy enabling traders to profit from transient discrepancies in relative value of close substitutes. An opportunity could vanish within a few seconds if the trader is not vigilant enough. For example, in the previous case, if the current index value is equal to strike price spot price = strike price, the option is ATM. Communications: When You use the Website or send emails or other data, information or communication to us, You agree and understand that You are communicating with Us through electronic records and You consent to receive communications via electronic records from Us periodically and as and when required. Traders may enter long or short positions accordingly, with stop loss orders placed on the opposite side of the breakout level to manage risk. However, leverage amplifies your profits and losses, so be sure to take steps to minimise this risk. Regardless of their complexity, all options strategies are based on the two basic types of options: the call and the put.